Zero is the number of new kilometres of underground lines inaugurated over the last two years; this is alarming evidence arising from the report “Pendolaria 2021”, which focuses on commuting in Italy, and which was recently published by Legambiente (one of the well-known environmental associations in Italy).

COVID-19 has probably emphasised the difficulties of the mobility sector in Italy and has modified the market and habits, highlighting the limits in the current public transport system and threatening the going concern of market operators. New rules for public transport, particularly social distancing, have impacted public mobility demand, leading people to reconsider the use of cars. New rules have also impacted the profitability of market operators and their investment plans.

A recent survey issued by Moovit1 on how the pandemic changed mobility habits in Italy reports that in 2020 15% of users did not travel due to smart working and lockdown; 42% reduced travel by public transport; 35% continued using public transport; only 3% increased it, and the remaining 6% moved from public to private means of transport.

The European Commission and the Italian Government have consequently adopted measures to stimulate the sector, fixing targets and priorities to design the future mobility systems. These measures are generally inspired by criteria of equality, innovation, and sustainability.

The Next Generation EU (NGEU) is a new temporary funding instrument promoted by the European Commission, aimed at providing an exceptional and strong response against the economic and social crisis brought by the COVID-19 pandemic. The inspiring pillars behind the Next Generation EU programme focus on:

- supporting Member States to recover from the crisis;

- kick-starting the economy and helping private investment; and

- learning lessons from the crisis.

According to NGEU, the total budget allocated to Italy is expected to be Euro 223.91 billion (as of January 2021).

Within this framework, the Italian Government is adopting a specific plan (the Recovery and Resilience Plan - “RRP”) for reforms, public investments, and stimulus to private investments. The plan has to be submitted by the Italian Government to the European Commission by 30th April 2021 to access NGEU funding; it identifies priorities and criteria to support the service and industrial sectors. The Italian RRP is based on six “Missions” aimed at implementing and improving actions in specific thematic areas that are strategic to the country’s growth and its future. Two of these Missions have special impacts on the mobility sector: Mission 2 - green revolution and ecological transition; and Mission 3 – infrastructure for sustainable mobility.

Breaking down Mission 2 and Mission 3 allows us to better understand the Italian Government’s position regarding the support to the future of mobility and some interesting indications about the dimension of the financial support granted to the sector. The table below summarises the allocation of European funds between the different segments of the mobility sector.

| Mission # |

Project |

Resources for existing projects |

Resources for new projects |

Total |

% on NGEU |

| 2 |

Sustainable local transport, cycle lanes, and fleet renewal |

2.95 |

4.60 |

7.55 |

3.4% |

| 3 |

Rail works for mobility and high speed lines |

11.20 |

15.50 |

26.70 |

11.9% |

| 3 |

Highway safety works and remote monitoring |

0.00 |

1.60 |

1.60 |

0.7% |

| 3 |

Ports and intermodal logistics |

0.48 |

1.62 |

2.10 |

0.9% |

| 3 |

Green Ports and cold ironing |

0.00 |

1.22 |

1.22 |

0.5% |

| 3 |

Airports digitalisation and logistics systems |

0.00 |

0.36 |

0.36 |

0.2% |

| |

Total |

14.63 |

24.90 |

39.53 |

17.7% |

Source: Italian Parliament Dossier dated 25th January 2021 – Piano nazionale di ripresa e resilienza - doc. XXVII, n. 18 on Government proposal dated 12th January 2021

Aggregated numbers indicate that NGEU funds in Italy are expected to commit about 18% of the total national resources to mobility. This can represent a significant result in terms of relevance especially considering the number and the importance of other intervention areas included in the Italian PRR, such as the digitalisation of the country, circular economy, energy transition, instruction and research, inclusion policies, and health.

The action plan underlying figures for Mission 2 highlights that the main priorities are: developing shared mobility, green local public transport (adopting low emission technologies like Electric Vehicles, Hydrogen and LNG or CNG), Mass Rapid Transit (metro and bus rapid transit) and cycle lanes (new ones to be built in 40 major cities). The action plan for Mission 3 is mainly addressed to the rail sector and aimed to achieve a purpose with a wider geographic scope that consists of connecting the country and reducing disparities among regions (particularly between the North and the South). Investments under Mission 3 are also expected to develop a network of ports connected to the Trans-European Transport Network corridors. A sign reflecting the new order of priorities can also arise from the quantity of resources allocated to road infrastructures and airports that are in both cases below 1%.

In 2020, the Italian Government promoted, through the Ministry of Transport, domestic measures to support mobility, in particular, measures included in the so called “Relaunch Decree” issued in May 2020, which broadly focuses on enhancing the national mobility system and the Mobility Bonus for bicycles, micromobility electric vehicles, and shared mobility services (up to 500 Euro per person and only to applicants living in cities with more than 50,000 inhabitants). These measures are summarised in the following table (please note that measures regarding payroll subsidies/unemployment benefits have not been included in the analysis).

| Project/Sector |

Description |

New resources |

% on subtotal |

| Rail network |

Restoring the relief from toll applied to rail operators |

270 |

22.6% |

| Rail operators |

Compensation for incurred losses |

150 |

12.6% |

| Iron Bonus and Sea Bonus |

Supporting intermodal and combined goods transport, rail and maritime |

50 |

4.2% |

| Aviation |

Compensation for incurred losses |

130 |

10.9% |

| Ports |

Compensation for incurred losses |

30 |

2.5% |

| Local Public Transport |

Compensation for incurred losses and restore for compensations granted to final users |

500 |

41.8% |

| Public works safeguard |

Ensuring the completion of ongoing public works and safeguarding workers and operators involved |

40 |

3.3% |

| Taxi bonus |

Contribution to taxi fares for people with limited mobility |

5 |

0.4% |

| Road transport |

Supporting sector operators during crisis |

20 |

1.7% |

| |

Subtotal relaunch decree (only main initiatives) |

1,195 |

100% |

Source: Italian Law Decree dated 19th May 2020, n. 34 - articles from 196 to 215

The combined public support (EU and domestic) has aided the sector with partial restoration to losses, contribution to future investments and, more importantly, with strategic guidelines providing direction for future growth and development.

An overall analysis of the above public intervention schemes shows that national priorities can be identified in filling the infrastructural gap of the country (especially with respect to other EU members), moving to a sustainable and green mobility system, reducing geographical differences, granting equality in the access to infrastructures, and last but not least attracting private capitals especially where they are not present yet. Above these priorities stand structural and essential aims that public support is pursuing to achieve, such as innovation, digitalisation, social inclusion, gender parity and youth employment.

It is worth noting that public contribution, be it national or part of the NGEU scheme, will contribute towards increasing the national debt. Consequently, it will be crucial that financed projects demonstrate their ability to generate a positive contribution to the future of the domestic economy since their planning phase.

In conclusion, all programmed public supports can be more successful if a virtuous approach triggers the involvement and commitment of private investors. This is an essential condition to obtain financial leverage on projects, multiply available resources for the country, and reduce future public debt.

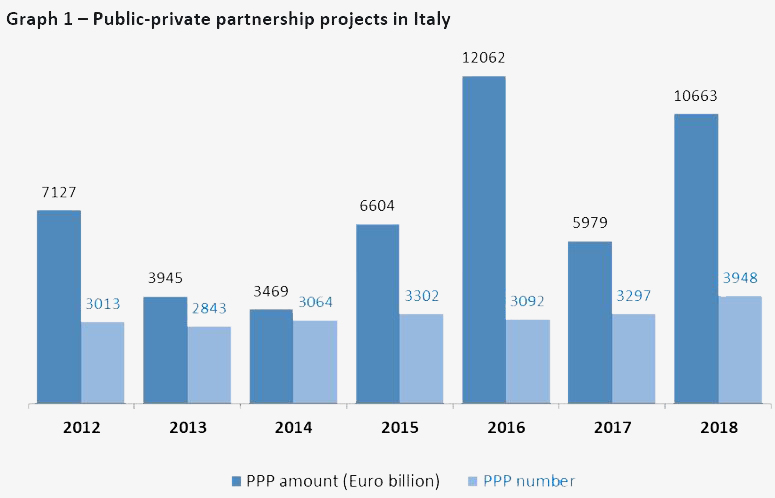

Source: The PPP market in Italy – Report 2018 issued by CRESME Europa Servizi

A blend of public and private resources could represent the success of mobility projects and can contribute to increasing the initiative’s overall performance. The above graph analyses the use of the PPP scheme in Italy from 2012 to 2018. It clearly appears the relevance of this instrument of cooperation between public and private showing a general increasing trend in terms of number of projects (CAGR equal to 5%) and considerable total amounts in terms of values (Euro 10,7 billion in 2018).

Public-private partnerships are ruled by Italian law and are becoming increasingly applied in the mobility sector giving private operators the possibility to invest in projects with an efficient allocation of risks for both parties (public and private) and basing debt repayment and equity returns on the capability of the initiative to generate an adequate level of cash flows. In this light, a feasibility study is usually recommended and should include the preparation of economic and financial projections in order to prove the sustainability under the financial point of view, including the so called bankability of the projects through the monitoring of standard bank covenants. The involvement of private investors such as corporates, private equity funds and private debt funds will be strategic for the successful and complete recovery from the COVID crisis and institution will have to introduce proper reforms, as well as simplification in public administration procedures and automatic incentive mechanisms (including tax benefits). Attracting private capitals is an additional and effective way to provide stimulus to the economy of the mobility sector, increasing market performances and above all the quality of life for mobility users.

A new future is waiting, let’s not be late stuck in traffic!