Many toll road facilities have been hit hard by the COVID-19 crisis. Extended periods of lockdown have drastically reduced demand for personal travel – and impacted on the movement of goods. At the same time, for those who do still wish/need to travel, the attractiveness of toll roads has also fallen – largely through the drop in traffic (and hence congestion) on the competing free alternatives.

The traffic reduction that we have seen has varied widely across different assets. This has primarily reflected the nature and severity of the lockdown restrictions – broadly a political decision taken at a national level. However, within this, it is clear that the response of the different traffic markets is also very significant.

Steer has been carrying out a scenario analysis – using our international experts to develop different pictures of how the world might look as we move on from now. A report of that analysis can be made available as requested.

In this note, we take the ‘boundary’ scenarios and explore what the impacts of these might be on levels of demand on four particular assets – toll facilities in Asia, Europe and North and South America.

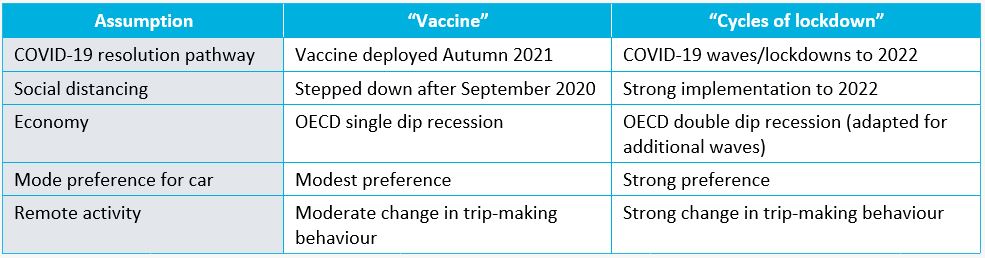

These scenarios we have titled “Vaccine” (least impact) and “Cycles of Lockdown” (biggest impact). We believe these represent plausible upper and lower bounds of post-COVID-19 outcomes for economy, activity and transport demand.

Our summarised scenario assumptions are shown in the table below:

Case study: India

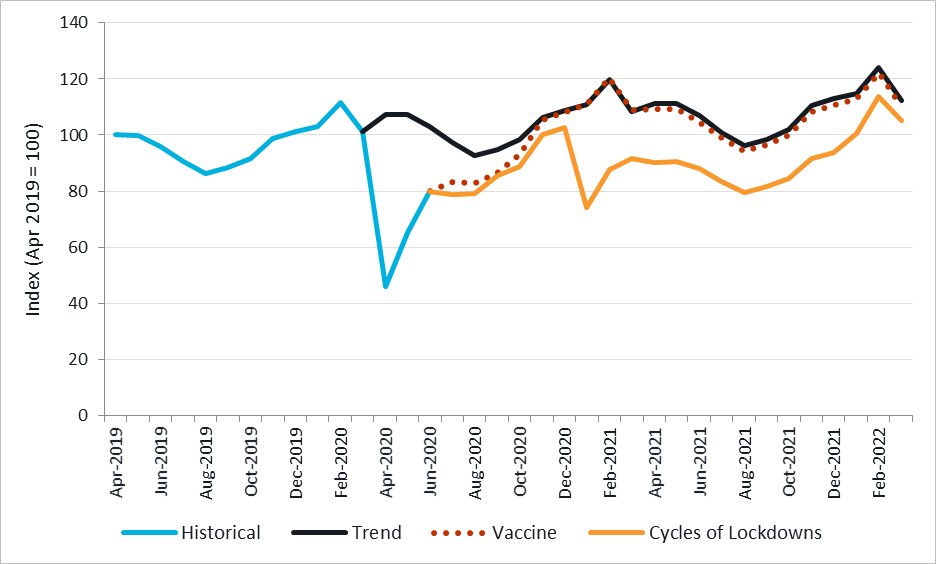

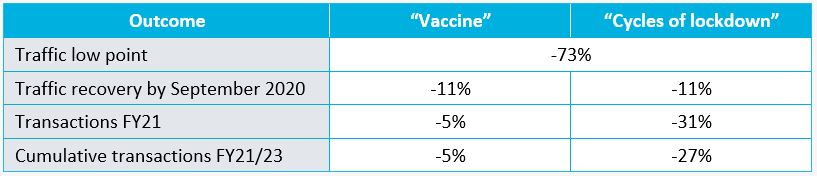

In the chart below we present historic and scenario traffic for an interurban toll road in India serving a mainly industrial corridor market and with a high proportion (>60% of total PCU’s) of trucks. The black line shows the likely traffic trend had the COVID-19 crisis not happened.

The table below shows a comparison of traffic and transaction metrics between our two scenarios and the counterfactual:

- Commercial vehicles make up 30-40% of traffic volumes but contribute over 70% of revenues. Movement of goods was initially impacted by the national lockdown but since April restrictions have been eased, which has led to a quick recovery. By June 2020, commercial vehicles across major national highways have recovered to 80-90% of pre-COVID-19 levels.

- Cars have seen a slow but gradual return to normalcy. June 2020 traffic levels varied between 60-75% of pre-COVID-19 levels; however local lockdowns and impacts vary asset by asset depending on state rules and passenger traffic levels remain volatile.

- In the "Vaccine" scenario, we believe traffic will track the trend line from November 2020, with 90%-100% recovery in cars and commercial vehicles.

- In the "Cycles of Lockdown" scenario, we think there is high possibility of local lockdowns in the near term, but with freight movements largely unaffected. Country wide lockdowns could follow by Jan 2021 if the virus remains uncontrolled.

Case study: Europe

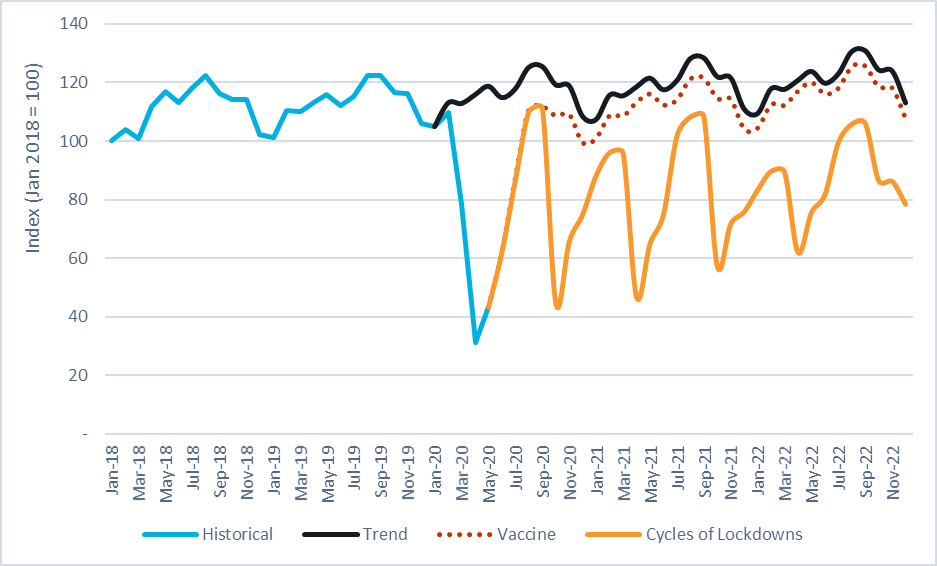

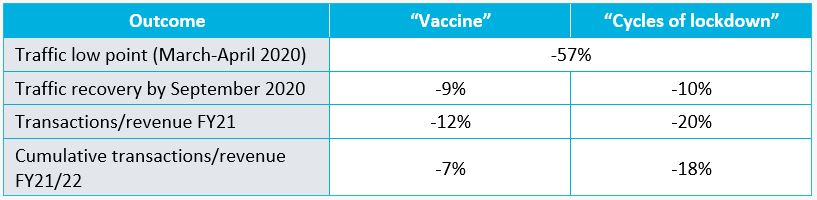

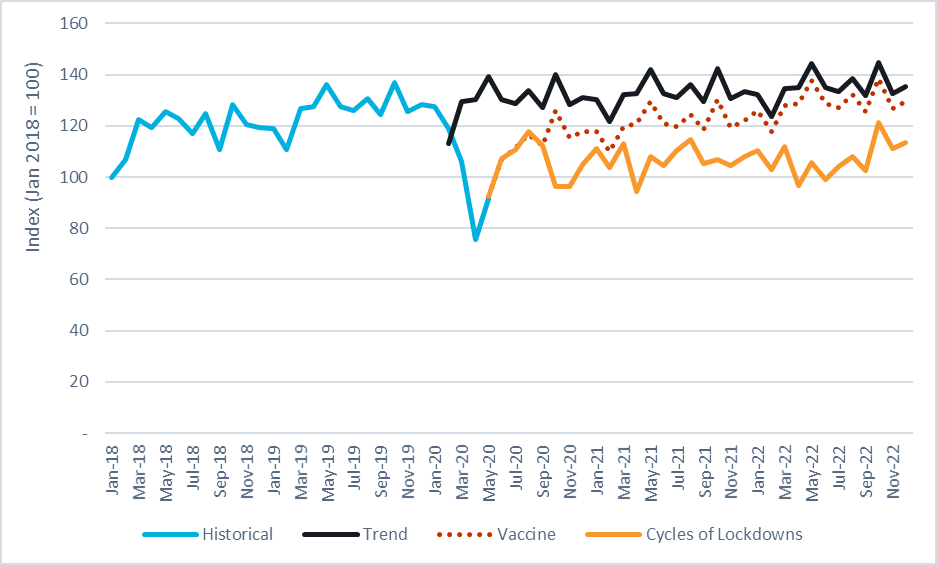

In the chart below we present historic and scenario traffic for an interurban toll road in Europe serving a mainly leisure market and with a low proportion of trucks. The black line shows the likely traffic trend had the COVID-19 crisis not happened.

The table below shows a comparison of traffic and transaction metrics between our two scenarios and the counterfactual:

- On this interurban, road cars make up around 80% of the traffic and commercial vehicles 20%.

- Lockdown reduced car traffic to 20% of the trend in April-May. Easing of restrictions since May has led to a slow recovery with car traffic at 50% of trend by the end of June.

- Movement of goods was initially impacted by the national lockdown but since April restrictions have been eased which has led to a quick recovery. By June 2020, commercial vehicles across major national highways recovered to 80-90% of pre-COVID-19 traffic levels.

- We expect car traffic in the “Vaccine” scenario to continue to recover to around 95% of pre-COVID levels by Jan 2021. Commercial vehicles will recover and follow typical economic growth trends.

- In the "Cycles of Lockdown" scenario, we believe that car traffic will remain severely affected as infection waves build and are controlled with further lockdowns. The impact will lessen over time as the lockdowns become more localised and efficient.

Case study: USA

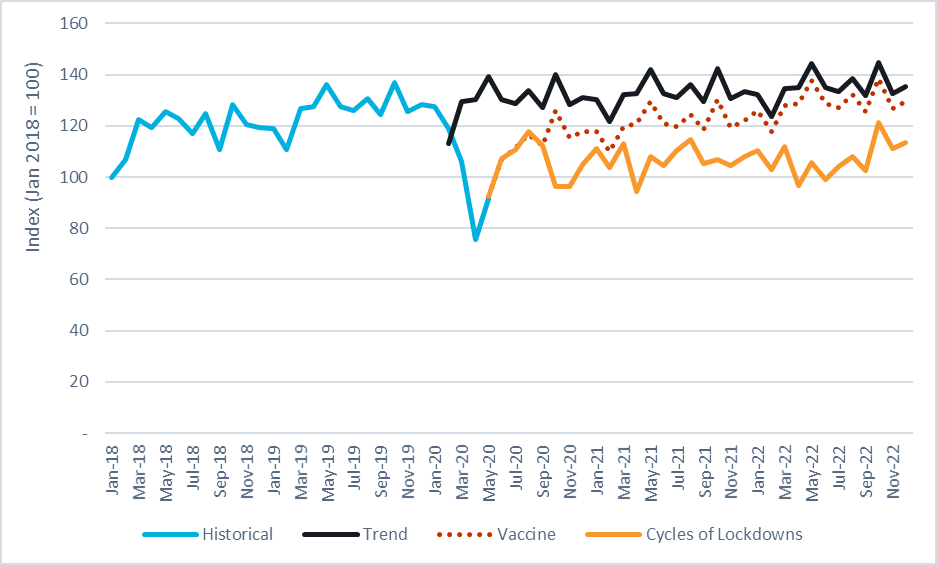

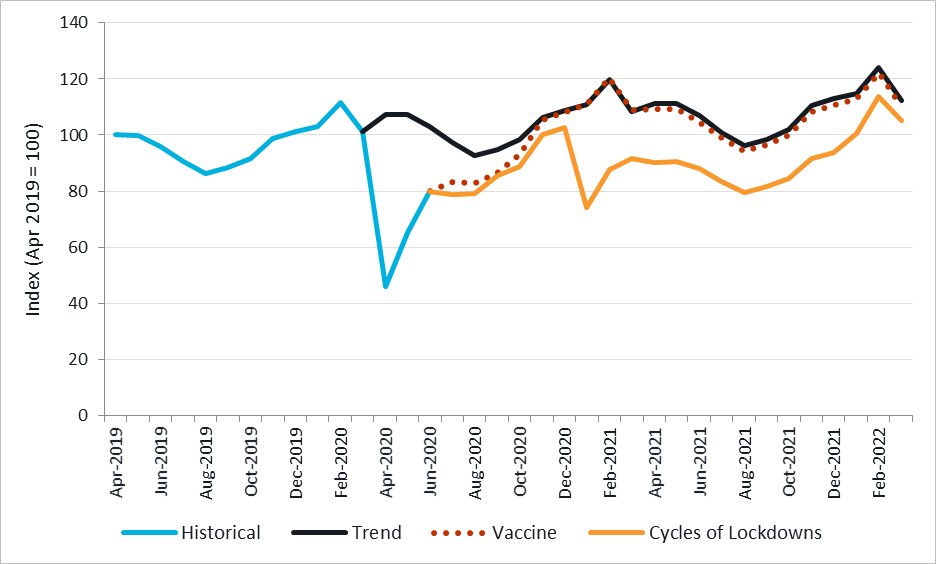

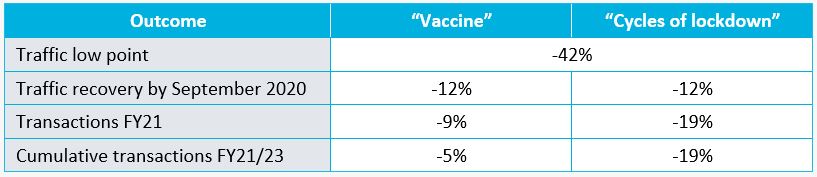

In the chart below we present historic and scenario traffic for a suburban toll road and bridge in North America serving a mainly commuter and leisure market and with a low proportion of trucks. The black line shows the likely traffic trend had the COVID-19 crisis not happened.

The table below shows a comparison of traffic and transaction metrics between our two scenarios and the counterfactual:

- This facility has limited alternatives (including a bridge) and operates at a relatively low toll rate which helped limit the degree of lost traffic (only 42% maximum).

- The recovery should continue, reaching 96% of the pre-COVID-19 expectation by October 2022 in the "Vaccine" scenario.

- For the "Cycles of Lockdown" scenario, the recovery will be slower, reaching 84% of the pre-COVID-19 expectation by October 2022.

- Across North America, truck traffic has experienced lower reductions than passenger traffic.

- Facilities with high shares of truck traffic and/or limited alternatives have tended to experience lower levels of traffic reduction.

- Facilities that provide congestion relief, such as managed lanes, have tended to experience higher levels of traffic reduction.

Case study: Colombia

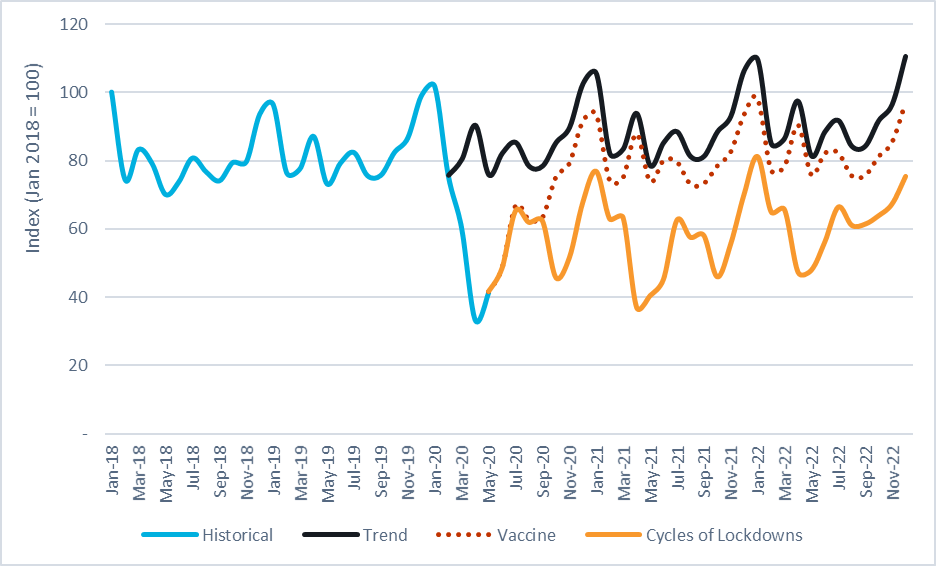

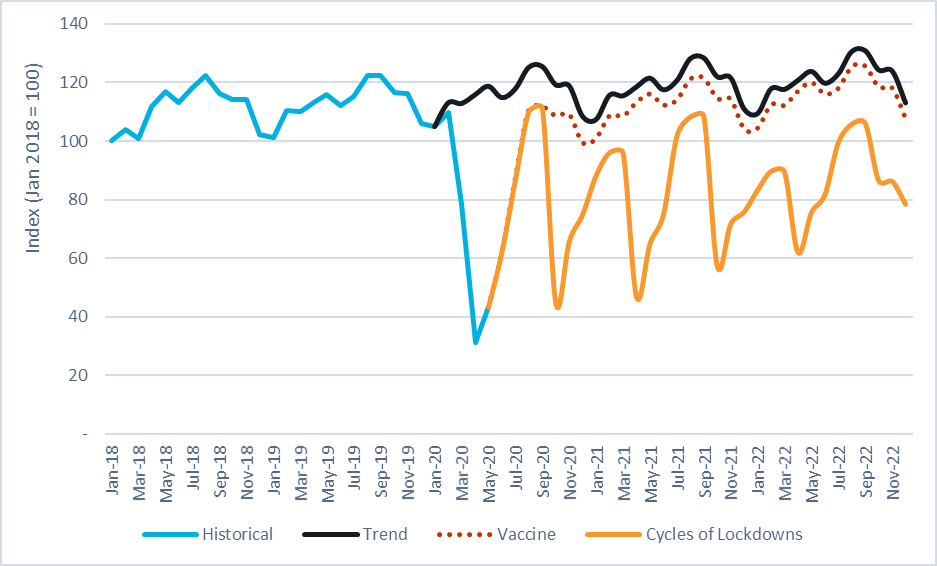

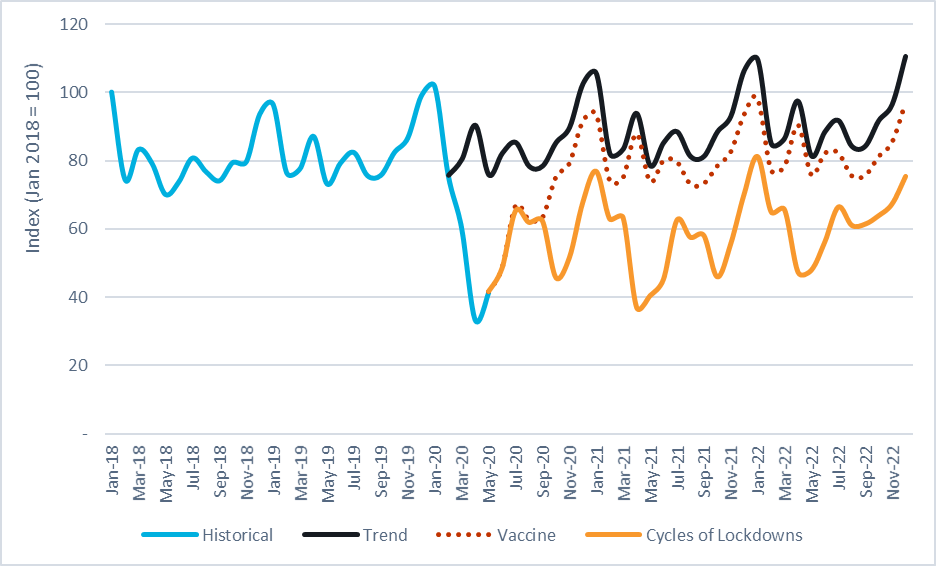

In the chart below we present historic and scenario traffic for an interurban toll road in Colombia serving a multipurpose market with a medium proportion of trucks. The black line shows the likely traffic trend had the COVID-19 crisis not happened.

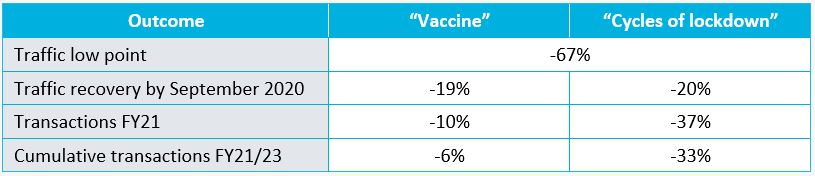

The table below shows a comparison of traffic and transaction metrics between our two scenarios and the counterfactual:

- Colombia is one of the few countries where tolling was suspended during national lockdown (March 26-June 1) but traffic still fell by 67% by mid-May.

- Heavy trucks, which accounts for 20% of total traffic and 35% of revenues, were only marginally affected. In this case study, they fell by 10% and have now returned to normal volumes. There are several assets around the country where truck transactions were higher than pre-COVID-19 levels by May 2020.

- Like in the case study, cars were severely impacted nationally by lockdown with reductions of 60-80%. Leisure and non-essential trips have been restricted since March and are not expected to return to normal before 2021 but are likely to see a spike in the medium-term on local roads from tourism as all commercial air travel is indefinitely suspended.

- The national lockdown has shifted the COVID-19 peak and it is now expected to occur between mid-August and early September. It is highly possible that new local confinement measures will be considered in 2020 second semester.

Key takeaways

At the time of writing, the outlook for tolled facilities appears mixed:

- Where commercial vehicles generate the majority of revenue, traffic (and revenue) has recovered rapidly. However, the medium-longer-term impact of an economic downturn is likely to erode growth.

- The recovery of car traffic has been slower. However, in our "Vaccine" scenario, car traffic recovers to 80-95% (depending on the location and context of the toll facility) of trend by 2021.

- The traffic and revenues implied by our "Cycles of Lockdown" scenario could be challenging for toll operators depending on coverage ratios and reserves; toll rate adjustments or other operational measures may be needed.

- Context is everything. Another facility in one of our case study countries may have very different outcomes – with infection rates, local lockdown policy, urban/interurban and level of freight all affecting traffic levels.

If you would like to know more please contact: Jon Peters, Serbjeet Kohli, David Cuneo, Jose Daniel Hernandez or Lucia Ferreira.

Important notice: The scenarios and analysis presented here does not constitute advice from Steer and is not for the use of any other party. This analysis is provided as an indicative estimate of possible outcomes. Actual outcomes are dependent on a range of factors which may differ from those employed in this analysis, accordingly actual outcomes may differ from those presented here.